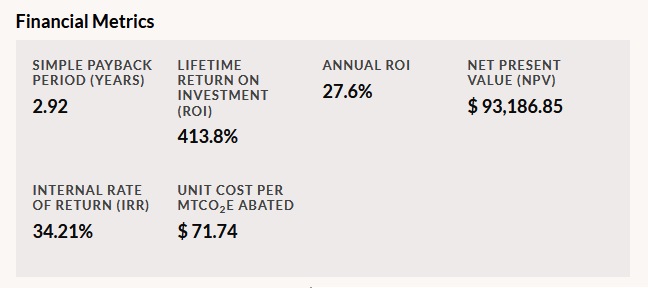

On the right side of the Project Details page, just below the Impact Metrics table, you will see a Financial Metrics box with calculations made by GRITS that illustrate your project’s financial performance.

- The Simple Payback Period is the amount of years it takes this project to pay back its cost from its financial savings. If the annual financial savings are not enough to repay the project cost within the lifespan of the project, the Simple Payback Period will appear in red. You may want to confirm that the lifespan, annual adjustment (unit savings), and project cost have been entered correctly in that situation (they could be correct if the project is valued more for its significant reductions in energy use, carbon emissions, water use, or waste production).

- Lifetime Return on Investment (ROI) is calculated based on anticipated savings during the project’s whole lifespan. This figure will be large if the project has a long lifespan and a small cost, or both.

- Annual ROI takes the Lifetime ROI and annualizes it by dividing it by the number of years in the project lifespan.

- Net Present Value (NPV) and Internal Rate of Return (IRR) take into account that savings today may be more valuable than savings in the future. Read more about the xNPV calculation that GRITS uses here or more about xIRR calculation that GRITS uses here. These financial calculations can help you determine if a project financially lucrative.

- Unit Cost per MTCO2E Abated shows how much it cost to reduce each metric ton of carbon dioxide equivalent emissions through this project.