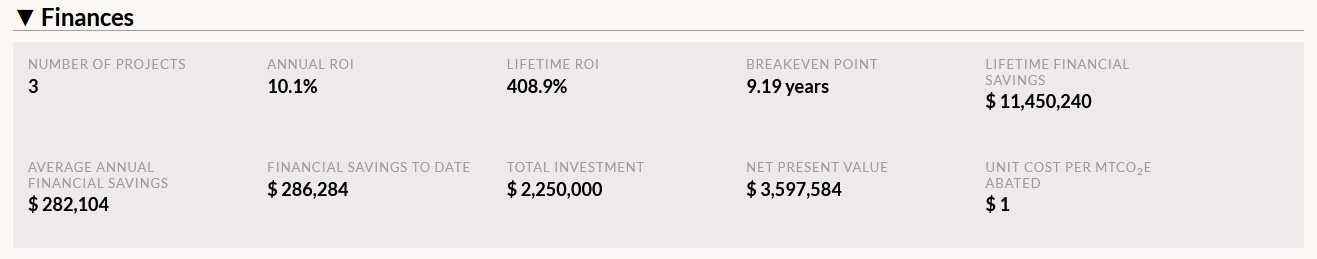

The Finances table describes the financial impacts of your scenario. You’ll first see the number of projects that belong to this scenario (they appear individually in the table of Scenario Projects below).

- Annual and Lifetime Return on Investment stats are calculated by treating the bundle of projects in the scenario like one large project.

- Annual ROI equation: Lifetime ROI / scenario lifespan in years

- Lifetime ROI equation: (total lifetime savings for all scenario projects – total cost of all scenario projects) / (total cost of all scenario projects)

- The Breakeven Point displays the amount of time it takes for aggregate project savings to equal the scenario’s total investment (as measured from the start date of the first scenario project). At that point, the scenario has paid for itself—even the projects that have yet to be installed. Single-project scenarios will have a Breakeven Point that matches that project’s Payback Period.

- Equation: Sum daily savings occurring from the earliest scenario project’s start date until savings break even with (equal or exceed) the total cost of all scenario projects. The amount of time covered over that period is the Breakeven Point.

- The Median/Average Annual Financial Savings calculation depends on whether you have selected the median or mean calculation of central tendencies in the “Math, Units, and Stats” sub-tab of the Settings page. Median is selected by default because it better excludes outliers. If median is selected, this metric will be called “median annual financial savings”. If you have selected mean, this metric will be called “average annual financial savings”.

- If median is selected: The bundle of projects in the scenario is treated like one large project. First, the individual project savings in each fiscal year are summed to get the scenario’s total energy savings in each fiscal year. The scenario’s total fiscal year savings are then arranged from smallest to largest, and the value in the middle is selected. If there is no single middle value, then the two values in the middle are averaged to calculate the median.

- If mean is selected: The bundle of projects in the scenario is treated like one large project. The lifetime savings for each project are summed and then divided by the scenario lifespan in years. The scenario lifespan is measured from the earliest project start date to project expiration date furthest in the future.

- Equation: [(Lifetime financial savings for project 1) + (Lifetime financial savings for project 2) + …] / (scenario lifespan in years)

- The Financial Savings To Date metric is calculated by adding the financial savings to date for all projects in this scenario. For Proposed projects, savings to date are measured from their implementation date in the scenario rather than the projected install complete date on their Project Details page (therefore the savings to date displayed on a Project Details page may not match the savings to date used in the scenario’s calculation).

- Equation: (Financial savings to date for project 1) + (Financial savings to date for project 2) + …

- The Lifetime Financial Savings metric is calculated by adding the lifetime financial savings for all projects in this scenario.

- Equation: (Lifetime financial savings for project 1) + (Lifetime financial savings for project 2) + …

- Total Investment displays the total cost of all projects in the scenario. Each project’s cost is the sum of its Project Expenditure transactions. If no Project Expenditure transactions have been created, then the project’s Proposed Cost is used.

- Equation: (Cost of project 1) + (Cost of project 2) + …

- Net Present Value as defined by Investopedia.com: ‘The difference between the present value of cash inflows and the present value of cash outflows.’ If it is positive, the scenario is a profitable investment. Estimated until end of scenario lifespan. Because the investments (projects) and savings occur at irregular intervals, the xNPV equation is used to calculate this metric.

- Unit Cost Per MTCO2e Abated is the cost of reducing carbon emissions. Estimated until end of scenario lifespan.

- Equation: Total Investment / Lifetime Emissions Abated