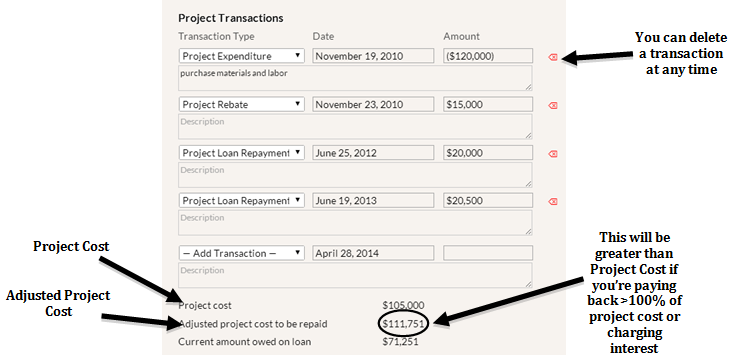

Project Transactions

You should enter transactions related to the project by entering the transaction type, date, transaction amount, and description (optional). Transactions inputted here for projects marked as In-Progress and Completed will be automatically transferred to the “Account Balance” table on the Dashboard to affect the total GRF account balance. It is important to note which transactions are positive (deposits) or negative (withdrawals) to the account. Transactions entered on Proposed projects are not factored into the calculations on the Dashboard, but they will be incorporated there once the project status changes to In-progress or Completed. If this project is Archived, the transactions entered will also not affect the Account Balance on the Dashboard (regardless of whether it is marked as In-progress or Completed), but you should still enter the Project Expenditure and the Project Rebate to indicate the final project cost.

- Project Expenditure – This transaction is entered once money is spent to implement the project (e.g. materials and labor). There can be multiple Project Expenditures in a single project if needed.

- This transaction will appear in parentheses once entered since it is negative to the GRF account.

- Project Loan Repayment – This transaction is used every time a payment is made back to the GRF from this project’s financial savings. For a given year, the recommended amount of Project Loan Repayment is in the Annual Tracking Data table, under the “Annual Payback into GRF” column.

- Project Savings – This transaction should be used if you pay back additional project savings to the GRF after the Adjusted Project Cost has been repaid. In this situation, you have probably already set the “Percent of savings paid after Adjusted Project Cost repaid” cell on the Settings page above 0 percent. Therefore, the “Annual Payback into GRF” column in the Annual Tracking Data table should reflect your additional savings payments, even after the project’s loan (Adjusted Project Cost) has been repaid. In fact, in the year where the project’s loan gets repaid, additional savings back into the GRF start getting calculated into this column mid-fiscal year. In that year, you will have to decipher the amount of the annual payback that is a “Project Loan Repayment” versus a “Project Savings” transaction. To indicate that you made these extra savings payments to the GRF, insert a Project Savings transaction.

- Project Rebate – Use this transaction when any incentive or rebate is received for the project.