Here you can set up strategies to repay extra project savings and grow the green revolving fund over time. These GRF repayment settings will override those configured on the Settings page. GRITS will use these settings as a guideline (the extra amount of savings to repay isn’t automatically counted as a transaction; see NOTE below), displaying the adjusted (extra) amount that you should pay back each fiscal year in the Annual Tracking Data table on your Project Detail page.

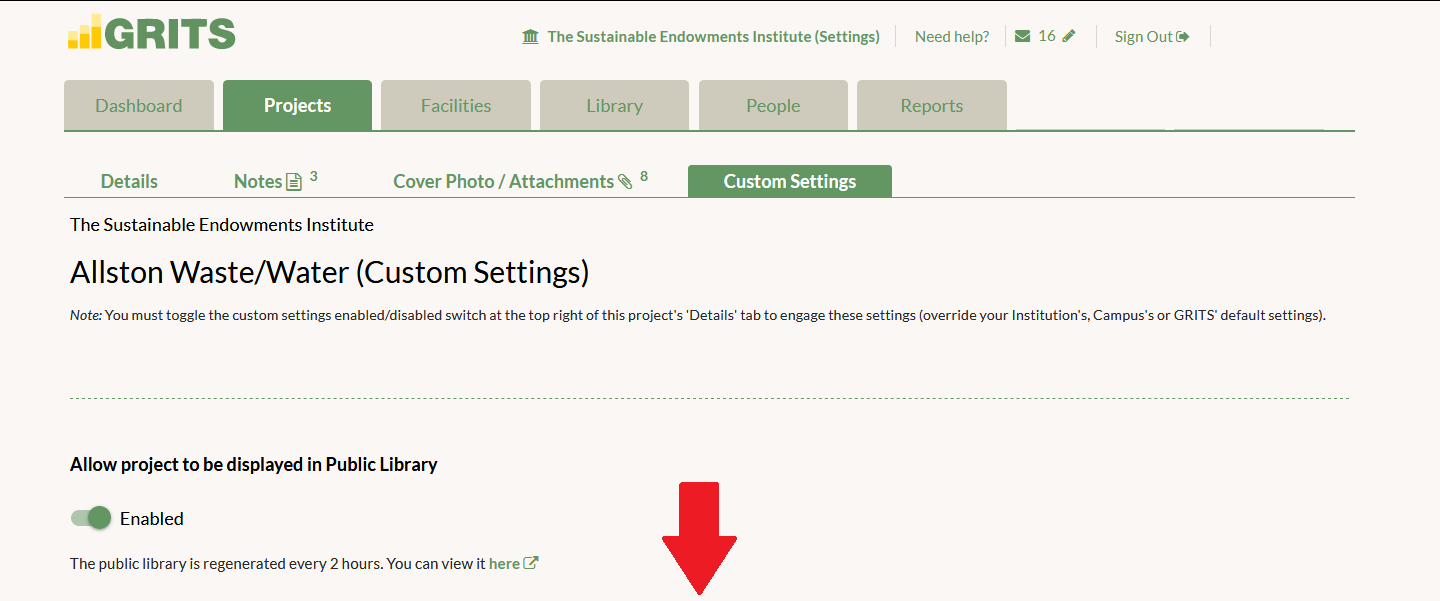

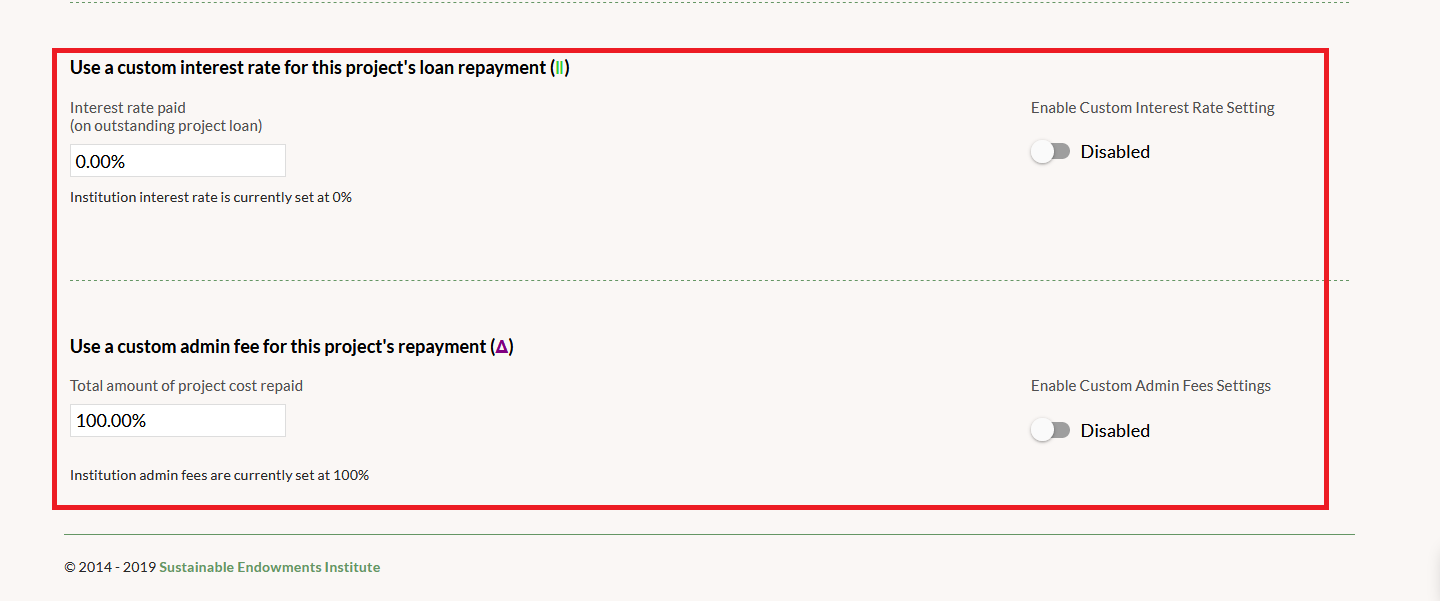

Go to the Custom Settings sub-tab and scroll to the bottom to find these settings. Once you’ve configured your interest rate and/or admin fee, make sure that the switch to the right of the setting is set to “Enabled”. Return to the Details page and make sure that the Custom Settings switch to the right of “Delete this project” is green and says “Custom Settings Enabled”.

- Interest rate – Some institutions charge an annual interest rate on the outstanding balance of project loans to increase the size of the GRF or to provide a return to the institution’s endowment or cash reserves if money was invested from either source. If using an interest rate greater than 0%, the annual principal and interest amounts will appear in the Annual Tracking Data table on the Project Detail page.

- Percent of project costs repaid (Admin Fee) – This is the percentage of the project cost (i.e. loan) that will be repaid to the GRF. The default is 100 percent, meaning you would repay the full cost of the project. Participants in the Billion Dollar Green Challenge must revolve at least 100 percent of the project cost back to the GRF, so that the fund stays the same size and does not decrease over time. Institutions can set this percentage greater than 100 percent as a means to grow the fund. For example, you can repay 120 percent of each project back to the GRF. If the project cost was $50,000, you would end up paying back $60,000 to the GRF in savings (the Adjusted Project Cost).

- Interest rate with percent of project costs repaid – Enable both GRF growth strategies to utilize them simultaneously.

*NOTE: Please note that the amount calculated through these options isn’t automatically added to your GRF’s account balance in GRITS—you must manually enter a Project Loan Repayment transaction on each Project Detail page to indicate when project savings have actually been repaid. This also allows you to indicate that a different size repayment was made than the guideline set up here.