GRITS is the only platform designed to help institutions track both the project investments and repayments involved when running a green revolving fund (GRF).

While most GRITS users don’t finance their sustainability projects through a GRF, those who do have additional features designed specifically to simplify the accounting required (check out a recorded training focused on these GRF features).

Easily keep track of fund balances, investments, and financial savings

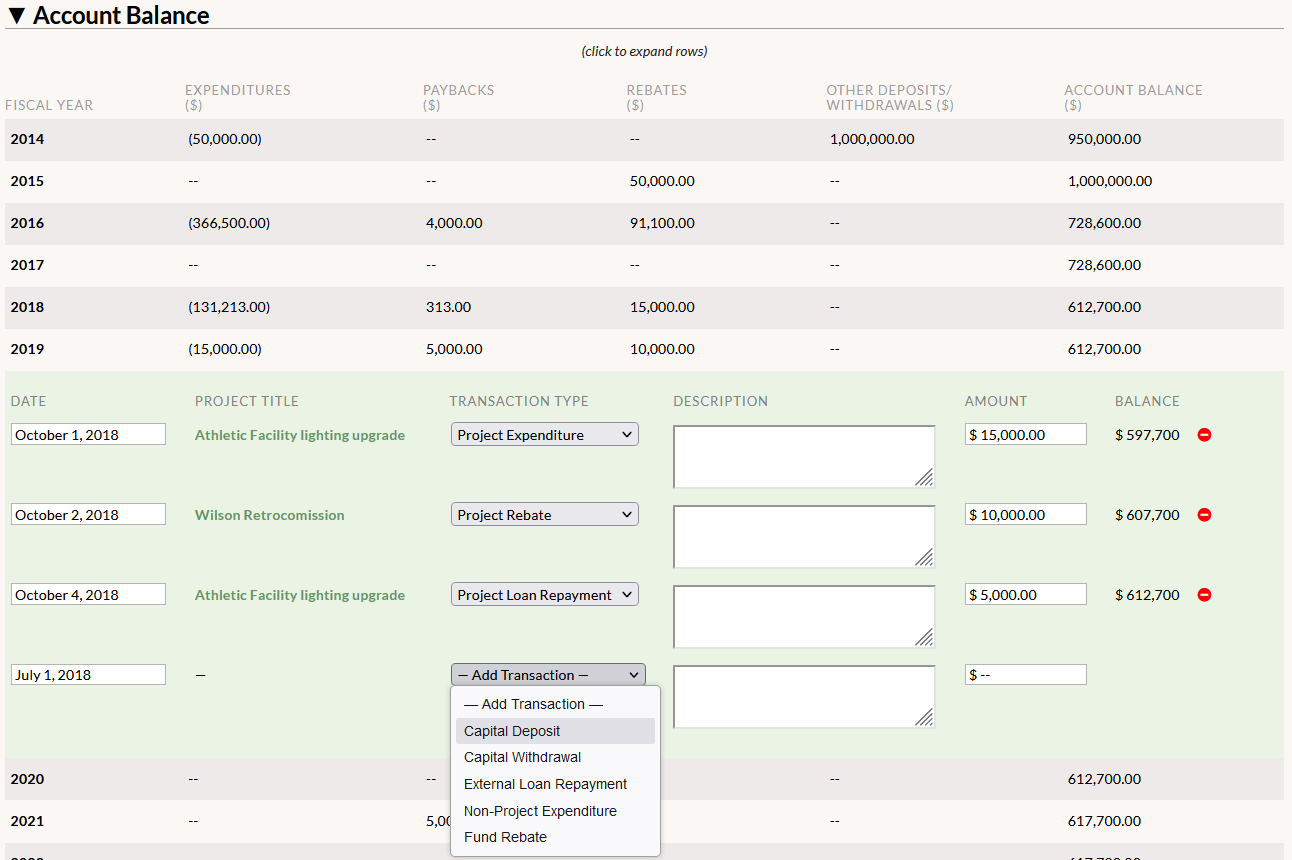

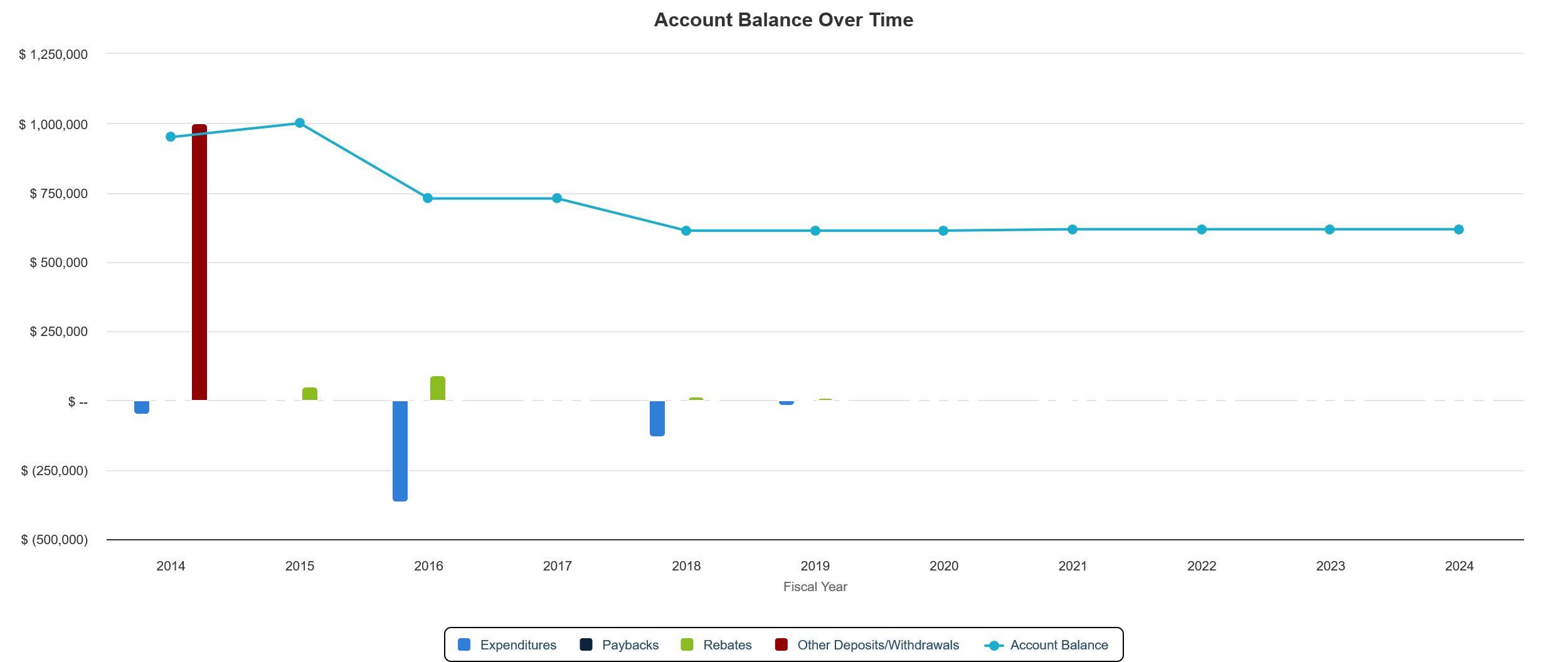

There are a number of figures that a GRF manager must keep track of: the total fund value, the balance available to be invested in new projects, and the outstanding amount currently invested in completed projects that are in their payback phase. GRITS helps you keep track of all three figures.

You can set your total fund value and adjust it whenever it grows (due to donations or other sources) or shrinks (if the fund was itself seeded with a loan requiring repayment, for example). You can find more information about fund-level transactions below.

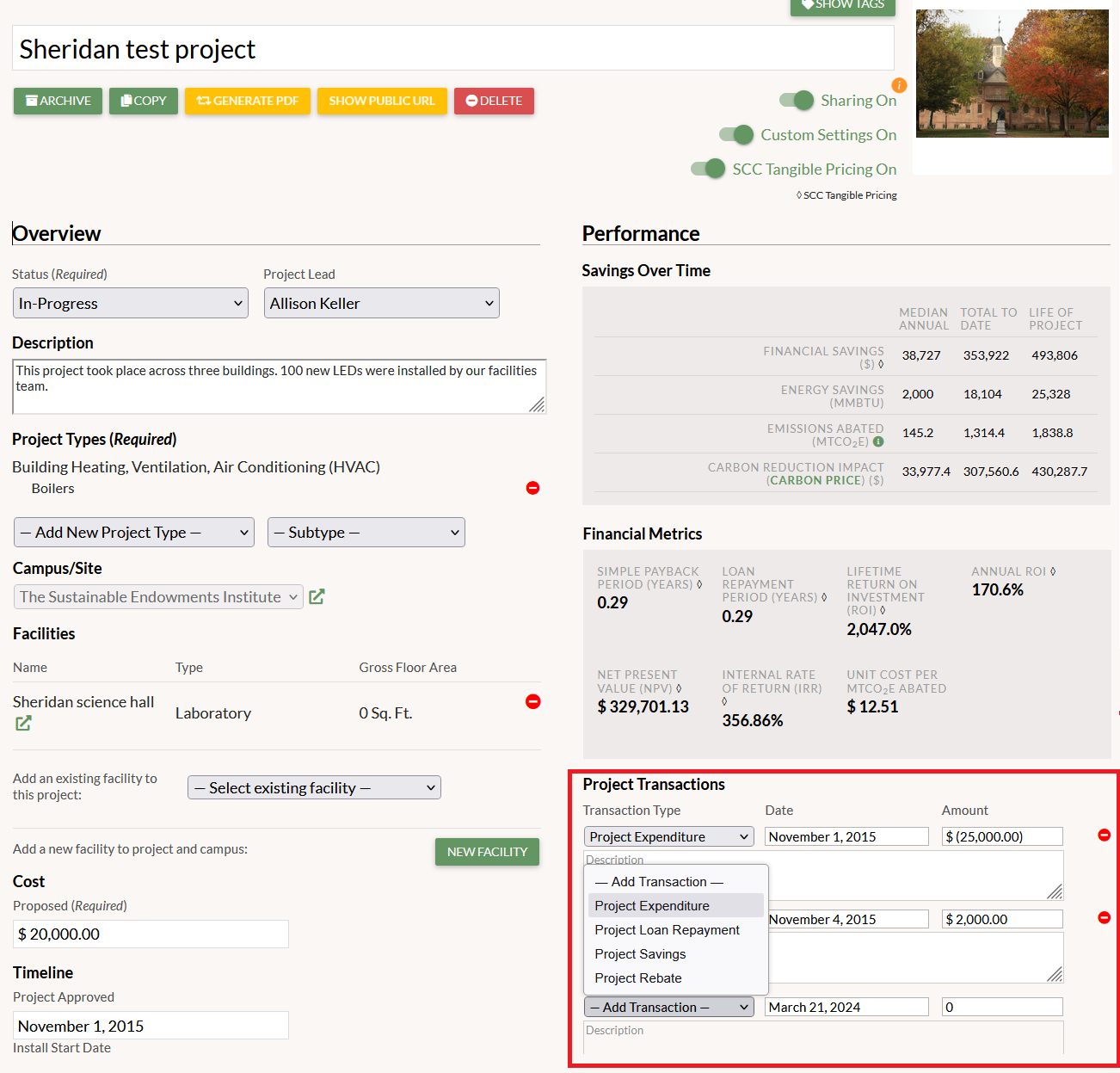

Each project-level transaction you enter, whether an expenditure, repayment, or even a rebate, will automatically recalculate the available balance and outstanding loan amounts for your fund.

GRITS also calculates two projections for you: 1) the fund balance as of today if all project loan repayments were made daily, and 2) the fund balance at the end of the fiscal year, with all anticipated loan repayments factored in. These projections can help you plan for your next round of project investments.

Lastly, you’ll see a tally of the amount of money invested in projects to date as well as the cumulative financial savings achieved by those projects to date.

See all GRF cash flows in one place

You can enter transactions at the fund level and at the level of individual projects. All of those transactions are organized in one place, so that you can easily keep track of all cash flows associated with your GRF.

Learn more about establishing your total fund value and other fund-level transactions here.

Learn more about project-related transactions here.

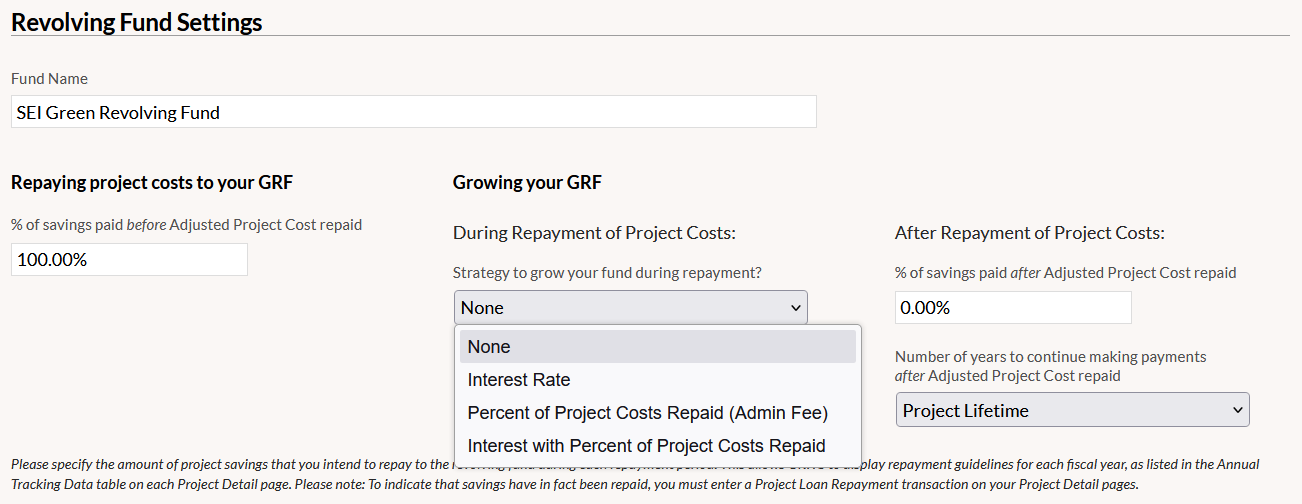

Set your GRF repayment guidelines, and GRITS will calculate the payback schedule for every project

GRITS allows you to specify the percentage of savings you’ll repay to your GRF for each repayment period. If you plan to grow your GRF over time, you can also indicate which strategy you’re using: charging an interest rate on the outstanding project loan, planning to pay back extra savings based on the project cost (say, 110% of the cost rather than 100%), or continuing to pay back a certain percentage of savings (say 20%) for a period of time after the project cost has been repaid. These repayment guidelines allow GRITS to calculate a payback schedule for each of your projects.

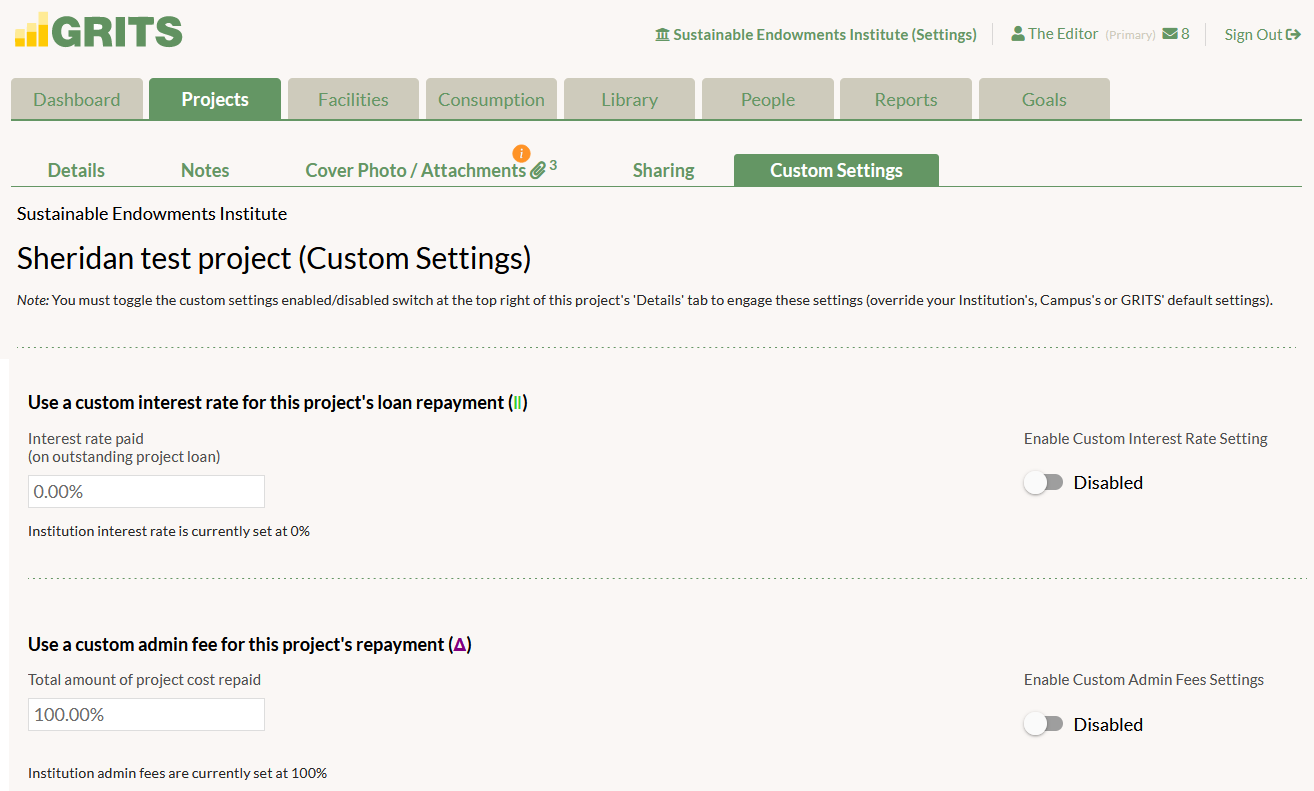

If you grow your GRF over time by charging an interest rate or by planning to pay back an extra percentage of the project cost, you can customize those rates for individual projects.

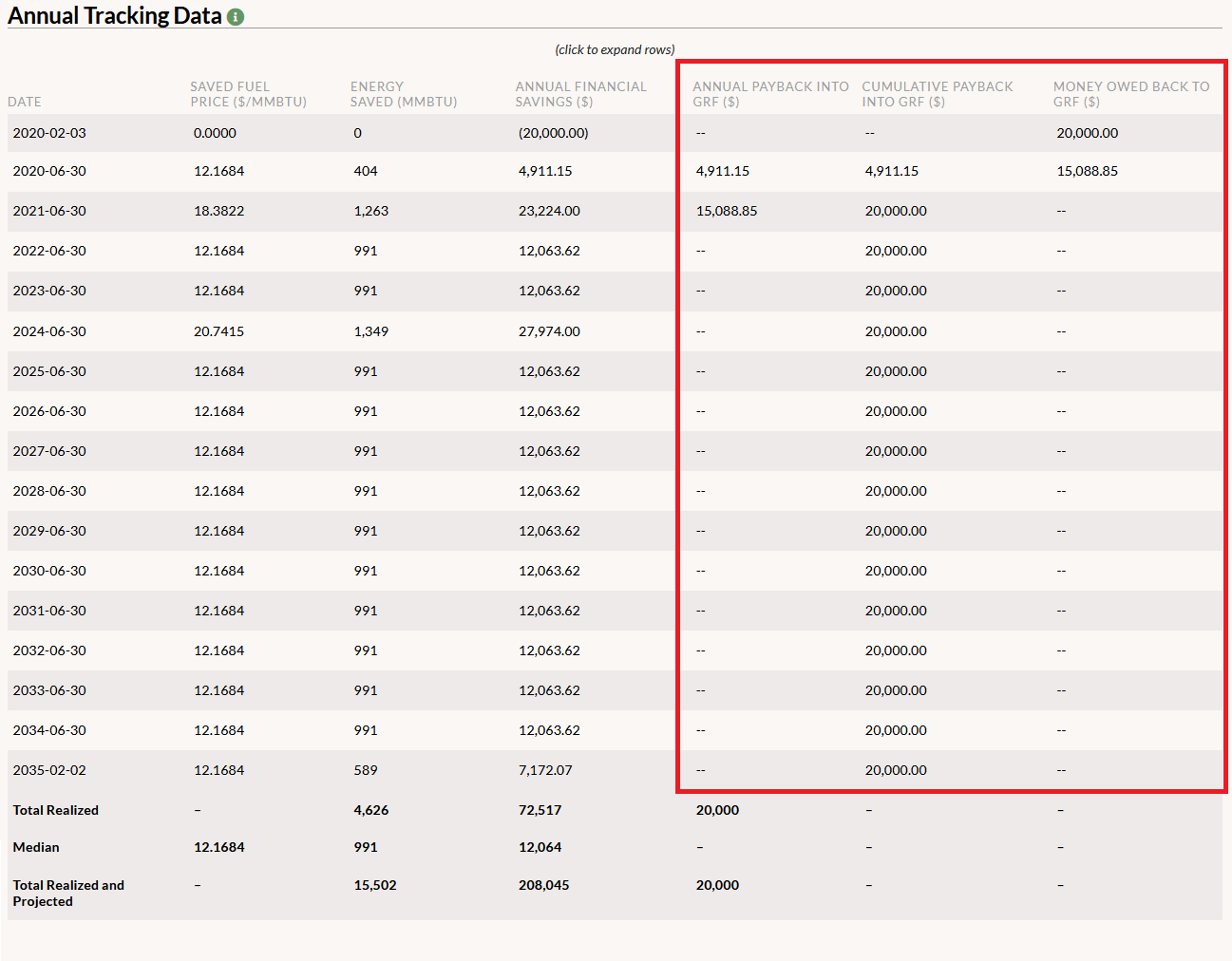

Each of your projects has an “Annual Tracking Data” table that displays both the projected financial savings for each fiscal year of the project’s lifespan and the payback schedule you should follow to adhere to your GRF’s repayment guidelines. All mechanisms used to grow the fund are factored into these calculations, as well as any updates made to resource prices or unit savings in any fiscal year.

Ultimately, you can customize the project loan repayment transactions you enter to match your actual cash flows, even if they differ from the schedule provided by GRITS. If you perform multiple repayments each year or you decide to repay a different portion of a project’s accrued savings, you can indicate that. Based on these transactions, GRITS keeps track of the outstanding loan balance for each project.

___

In addition to these GRF accounting features, GRITS provides much more functionality designed to support your efforts to reduce emissions and resource consumption. The platform calculates a host of project-level and portfolio-wide impact metrics (see which metrics GRITS calculates for you!) and offers several ways to communicate those impacts with others (see all the sharing options GRITS provides!).

If you’re looking for additional GRF resources, you can check out our survey of institutions across the United States with a GRF. It discusses common fund operating procedures, explores their benefits, and addresses commonly perceived barriers to getting started–including a section on GRF accounting. An appendix lists additional resources for learning more about GRFs and ways to establish one within your institution.

Interested in learning more about GRITS? You can check out a recorded training focused on the GRF features described above. Or contact us!